Paycheck Stub Transparency: The Right to Understand Your Earnings

In today’s complex world of employment, it is essential for workers to have a clear understanding of their earnings and how they are calculated. A crucial tool in achieving this understanding is the paycheck stub, which provides a breakdown of an individual’s income and deductions. Paycheck stub transparency is not just a matter of convenience; it is a fundamental right that ensures employees are fairly compensated and protected from potential wage theft or errors. This article explores the importance of paycheck stub transparency and the benefits it brings to employees.

What Is a Paycheck Stub?

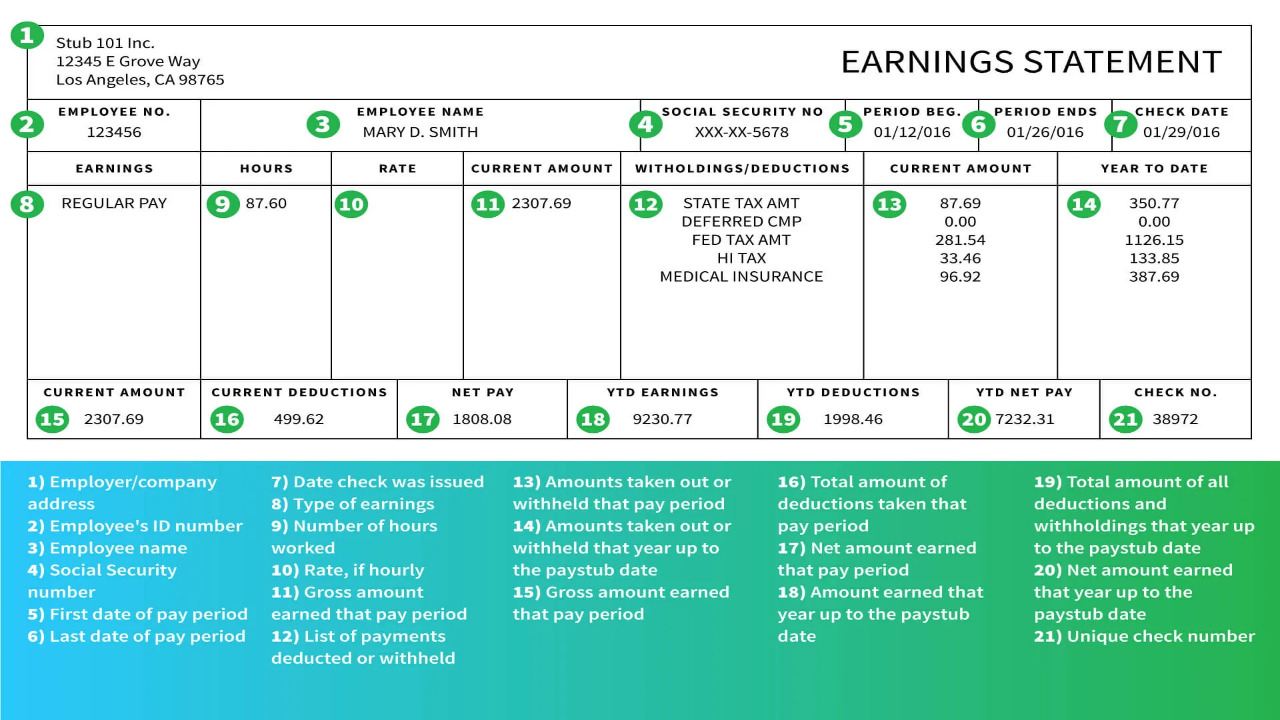

A paycheck stub, also known as a pay stub or payslip is a document that accompanies an employee’s paycheck. It provides detailed information about the employee’s earnings, including their gross pay, deductions, and net pay. It serves as a record of income and serves various purposes, such as tax filings, proof of employment, and tracking earnings. Remember that you can make all the processes connected to your paycheck stubs easier with a PayStubCreator.net website or any similar tool.

Breaking Down the Components

One of the primary benefits of paycheck stub transparency is that it allows employees to understand the breakdown of their earnings. A well-designed paycheck stub clearly outlines the various components that contribute to an employee’s income, including regular wages, overtime pay, commissions, bonuses, and reimbursements. This level of transparency empowers workers to ensure they are being paid correctly and fairly for their efforts.

Shedding Light on Withholdings

Paycheck stub transparency also extends to deductions, which are amounts subtracted from an employee’s gross pay to cover taxes, insurance premiums, retirement contributions, and other obligations. By clearly itemizing these deductions on the paycheck stub, employees can better comprehend why certain amounts are withheld and how they impact their overall earnings. This knowledge helps foster trust between employers and employees and ensures compliance with relevant labor laws.

Protection Against Wage Theft and Errors

Paycheck stub transparency plays a vital role in protecting employees from wage theft and errors. Wage theft can occur in various forms, such as unauthorized deductions, miscalculations, or underpayment of wages. By providing employees with a clear and detailed paycheck stub, employers establish accountability and transparency, making it easier to identify and rectify any discrepancies. This level of transparency also acts as a deterrent against unscrupulous employers who may seek to exploit their workforce.

Empowering Financial Planning and Budgeting

Understanding one’s earnings is crucial for effective financial planning and budgeting. Paycheck stub transparency enables employees to accurately assess their income, track changes over time, and make informed decisions about savings, investments, and expenses. Armed with this information, individuals can plan for their financial goals, such as buying a home, paying off debts, or saving for retirement, with greater confidence and precision.

Legal Compliance and Workplace Rights

Paycheck stub transparency is not just a matter of personal financial well-being; it is also linked to legal compliance and workplace rights. Many jurisdictions have laws in place that mandate employers to provide detailed paycheck stubs to their employees. These laws are designed to ensure fair compensation and protect workers’ rights. By promoting paycheck stub transparency, we strengthen the foundation of a just and equitable work environment.

Conclusion

Paycheck stub transparency is a crucial aspect of employee rights and financial empowerment. By providing a clear breakdown of earnings and deductions, paycheck stubs enable workers to understand their income, protect themselves against wage theft, and make informed financial decisions. Employers should recognize the importance of transparency in this area and strive to provide accurate, comprehensive paycheck stubs that promote fairness, compliance, and the well-being of their workforce.